PERFORMANCE

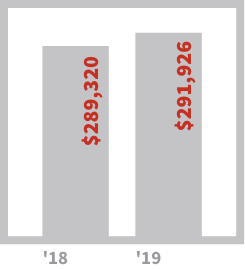

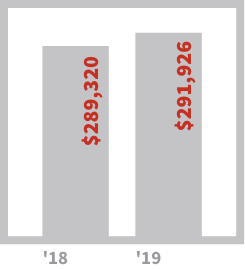

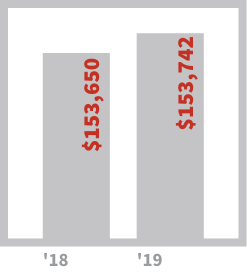

Millions of Mexican Pesos

HIGHLIGHTS OF THE YEAR

Excluding FX effect, net sales grew 2.5%, mainly due to good performance in Mexico and EAA.

Adjusted EBITDA1 increased 5.4%, with a margin expansion of 50 basis points reaching 11.5%.

Free Cash Flow amounted to $2.4 billion pesos.

Net debt to adjusted EBITDA ratio decreased to 2.4x.

- NET SALES

- GROSS PROFIT

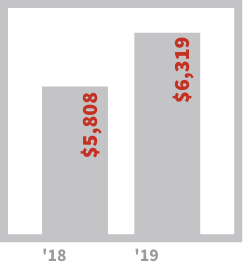

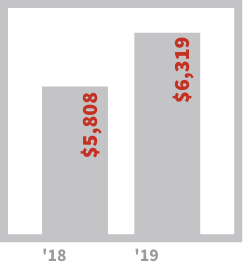

- ADJUSTED EBITDA

- OPERATING INCOME

- COMPREHENSIVE FINANCIAL RESULT

- NET MAJORITY INCOME

- FINANCIAL STRUCTURE

NET SALES

Net sales during 2019 grew 2.5%, excluding FX effect, as a result of organic growth in Mexico and EAA, coupled with strategic bolt-on acquisitions completed during the period; including FX effect, net sales increased 0.9%.

NORTH AMERICA 2

For the full year, net sales remained flat, primarily due to continued execution of the portfolio optimization strategy implemented in Q2 in the US, which was offset by strategic brands growth in the US, strong performance in Canada and the sweet baked goods and snacks categories throughout the region. The competitive environment in the premium category and compression of the private label category in the US continued to be a challenge.

MEXICO 3

For the full year net sales improved by 2.4%, primarily reflecting strong volume growth across most categories, particularly buns, cookies and cakes and every channel, with the convenience channel outperforming.

LATIN AMERICA 4

Net sales in Latin America decreased by 4.2%, for the full year, attributable to a weak performance in Brazil and Argentina and FX rate pressure, which was offset by strong results across the Latin Centro and Latin Sur divisions, with Chile and Peru outperforming.

EAA 5

For the full year, net sales grew 2.9%, driven by good performance of Iberia and Bimbo QSR, with outperformance from the bread and sweet baked goods categories.

1. Adjusted EBITDA: Earnings before interest, taxes, depreciation, amortization, impairments, Voluntary Separation Program (“VSP”) and Multiemployer Pension wPlans charges (“MEPPs”).

2. North America region includes operations in the USA and Canada.

3. Inter-company transactions have been removed from Mexico.

4. Latin America region includes operations in Central and South America.

5. EAA region includes operations in Europe, Asia and Africa.

NET

SALES

+0.9 %

GROSS PROFIT

2019 gross profit slightly improved by 0.1%, with a margin contraction of 40 basis points, primarily reflecting higher raw material costs.

ADJUSTED EBITDA

2019 adjusted EBITDA increased 5.4% with a margin expansion of 50 basis points, attributable to positive operating performance in most regions and lower general and administrative expenses resulting from productivity initiatives.

NORTH AMERICA

Full year 60 basis points expansion in the margin was due to the efficiencies gained from restructuring initiatives and improved portfolio mix from growth in strategic brands and snacks.

MEXICO

The margin remained flat year over year, attributable to healthy sales performance and lower general expenses, as a reflection of cost-cutting initiatives, offset by higher raw material costs.

LATIN AMERICA

Latin America margin contraction was due to the macroeconomic conditions in Argentina and extraordinary expenses in Brazil, partially offset by lower general expenses in the Latin Centro and Latin Sur divisions.

EAA

EAA posted a strong 480 basis points expansion in the margin in 2019, as a result of the synergies achieved from the acquisition of Donuts Iberia, lower integration expenses and strong performance of the Bimbo QSR business.

ADJUSTED

EBITDA

+5.4 %

OPERATING INCOME

Full year operating income increased 10.3% and the margin expanded 60 basis points, as a reflection of good operating performance across most regions. Partially offset by the non-cash charges related to the adjustment of the Multi-Employer Pension Plans (“MEPPs”) liability registered in the second and third quarters, as well as restructuring investments mainly in North America and extraordinary expenses in Brazil.

OPERATING

INCOME

+10.3 %

COMPREHENSIVE FINANCIAL RESULT

Comprehensive Financial Result for the year totaled Ps. 8,560 million, 22.4% higher when compared to 2018. This increase was mainly related to a one-time expense from the US$600 million liability management transaction of the 2020 notes, a loss from the net monetary asset position in Argentina and the implementation of IFRS16.

NET MAJORITY INCOME

Full year net majority income increased 8.8% and the margin expanded 20 basis points, due to the improved operating performance and a lower effective tax rate, which stood at 39.1%.

NET MAJORITY

INCOME

+8.8 %

FINANCIAL STRUCTURE

Total debt at December 31st, 2019, was Ps. 86.7 billion, compared to Ps. 89.8 billion on December 31st, 2018.

Average debt maturity was 13.3 years with an average cost of 6.1%. Long-term debt comprised 94% of the total; 57% of the debt was denominated in US dollars, 38% in Mexican pesos and 5% in Canadian dollars.

The net debt to adjusted EBITDA ratio was 2.4 times compared to 2.6 times at December 31st, 2018.

The Company invested Ps. 1.8 billion in its share buyback program, buying back approximately 46.6 million shares.

CURRENCY

MIX

57% USD

38% MXN

5% CAD

NET SALES

Net sales during 2019 grew 2.5%, excluding FX effect, as a result of organic growth in Mexico and EAA, coupled with strategic bolt-on acquisitions completed during the period; including FX effect, net sales increased 0.9%.

NORTH AMERICA 2

For the full year, net sales remained flat, primarily due to continued execution of the portfolio optimization strategy implemented in Q2 in the US, which was offset by strategic brands growth in the US, strong performance in Canada and the sweet baked goods and snacks categories throughout the region. The competitive environment in the premium category and compression of the private label category in the US continued to be a challenge.

MEXICO 3

For the full year net sales improved by 2.4%, primarily reflecting strong volume growth across most categories, particularly buns, cookies and cakes and every channel, with the convenience channel outperforming.

LATIN AMERICA 4

Net sales in Latin America decreased by 4.2%, for the full year, attributable to a weak performance in Brazil and Argentina and FX rate pressure, which was offset by strong results across the Latin Centro and Latin Sur divisions, with Chile and Peru outperforming.

EAA 5

For the full year, net sales grew 2.9%, driven by good performance of Iberia and Bimbo QSR, with outperformance from the bread and sweet baked goods categories.

1. Adjusted EBITDA: Earnings before interest, taxes, depreciation, amortization, impairments, Voluntary Separation Program (“VSP”) and Multiemployer Pension wPlans charges (“MEPPs”).

2. North America region includes operations in the USA and Canada.

3. Inter-company transactions have been removed from Mexico.

4. Latin America region includes operations in Central and South America.

5. EAA region includes operations in Europe, Asia and Africa.

NET

SALES

GROSS PROFIT

2019 gross profit slightly improved by 0.1%, with a margin contraction of 40 basis points, primarily reflecting higher raw material costs.

GROSS

PROFIT

ADJUSTED EBITDA

2019 adjusted EBITDA increased 5.4% with a margin expansion of 50 basis points, attributable to positive operating performance in most regions and lower general and administrative expenses resulting from productivity initiatives.

NORTH AMERICA

Full year 60 basis points expansion in the margin was due to the efficiencies gained from restructuring initiatives and improved portfolio mix from growth in strategic brands and snacks.

MEXICO

The margin remained flat year over year, attributable to healthy sales performance and lower general expenses, as a reflection of cost-cutting initiatives, offset by higher raw material costs.

LATIN AMERICA

Latin America margin contraction was due to the macroeconomic conditions in Argentina and extraordinary expenses in Brazil, partially offset by lower general expenses in the Latin Centro and Latin Sur divisions.

EAA

EAA posted a strong 480 basis points expansion in the margin in 2019, as a result of the synergies achieved from the acquisition of Donuts Iberia, lower integration expenses and strong performance of the Bimbo QSR business.

ADJUSTED

EBITDA

OPERATING INCOME

Full year operating income increased 10.3% and the margin expanded 60 basis points, as a reflection of good operating performance across most regions. Partially offset by the non-cash charges related to the adjustment of the Multi-Employer Pension Plans (“MEPPs”) liability registered in the second and third quarters, as well as restructuring investments mainly in North America and extraordinary expenses in Brazil.

OPERATING

INCOME

COMPREHENSIVE FINANCIAL RESULT

Comprehensive Financial Result for the year totaled Ps. 8,560 million, 22.4% higher when compared to 2018. This increase was mainly related to a one-time expense from the US$600 million liability management transaction of the 2020 notes, a loss from the net monetary asset position in Argentina and the implementation of IFRS16.

NET MAJORITY INCOME

Full year net majority income increased 8.8% and the margin expanded 20 basis points, due to the improved operating performance and a lower effective tax rate, which stood at 39.1%.

NET MAJORITY

INCOME

+8.8 %

Total debt at December 31st, 2019, was Ps. 86.7 billion, compared to Ps. 89.8 billion on December 31st, 2018.

Average debt maturity was 13.3 years with an average cost of 6.1%. Long-term debt comprised 94% of the total; 57% of the debt was denominated in US dollars, 38% in Mexican pesos and 5% in Canadian dollars.

The net debt to adjusted EBITDA ratio was 2.4 times compared to 2.6 times at December 31st, 2018.

The Company invested Ps. 1.8 billion in its share buyback program, buying back approximately 46.6 million shares.

FINANCIAL

STRUCTURE

57% USD

38% MXN

8% CAD

6. Does not include debt at the subsidiary level of US$155 million.